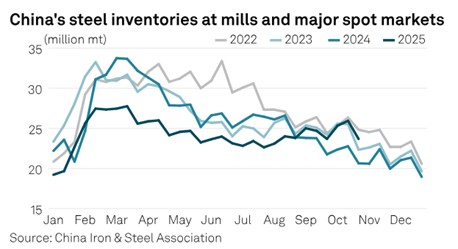

Finished steel inventories at steel mills and major spot markets monitored by the CISA totaled 23.68 million mt as of Oct. 31, nearly unchanged from the end of September but 14.7% higher than a year ago, CISA data showed.

In particular, rebar market inventories -- an indicator of construction steel demand -- were up 46.7% year over year at 3.55 million mt as of Oct. 31, the data showed.

Hot-rolled coil market inventories -- an indicator of flat steel demand primarily in manufacturing sectors -- stood at 2.21 million mt on Oct. 31, up about 16.9% year over year, according to the data.

Several China-based traders said construction steel demand remains under pressure from the property downturn, while manufacturing steel demand, though solid so far, may have limited upside potential in the near term.

"I hope fresh and effective stimulus measures will be announced in December during the Central Economic Work Conference to support the property sector and consumer spending, so the steel market can gain some upward momentum, at least in early 2026," a trade source said.

Another trade source said the property sector has recently shown signs of further decline, and the downtrend in property steel demand may continue into 2026.

The value of new home sales by 100 major developers fell 16.3% year over year to about Yuan 2.897 trillion ($406.9 billion) over January-October, with the pace of decline accelerating from 12.2% in the first nine months, according to Chinese property data provider China Index Holdings.

Meanwhile, China's domestic passenger car retail sales -- one indicator of consumer goods consumption -- dropped 0.8% year over year to 2.242 million units in October, according to the China Passenger Car Association. Over January-October, passenger car retail sales rose 7.9% year over year to 19.25 million units, CPCA said.

"Domestic passenger car consumption currently remains robust," a China-based mill source said. "However, because sales were exceptionally strong in the fourth quarter last year due to stimulus incentives, it will be difficult for passenger car retail sales to achieve further year-over-year growth in the fourth quarter this year."

The source added that without new stimulus policies in 2026, domestic sales of consumer goods like automobiles and home appliances may have limited potential for further growth.

China's steel production is likely to decline further over November-December amid the low season, another mill source said. However, weakening end-user demand means steel prices may struggle to gain upward momentum from production cuts and could continue fluctuating within a narrow range, the source added.